Place-based Payments for Ecosystem Service schemes are broadening to new land uses, habitats and services. The Woodland Carbon Code and Peatland Code already successfully source private funding public goods delivery alongside public funding. Now Landscape Enterprise Networks (LENs) are pooling funds from multiple private investors to deliver public goods across a broader range of land uses and habitats than ever before. In this blog, Prof Mark Reed summarises existing evidence behind the LENs approach, and considers the role of public-private partnerships in post-Brexit agricultural policy.

What are Landscape Enterprise Networks?

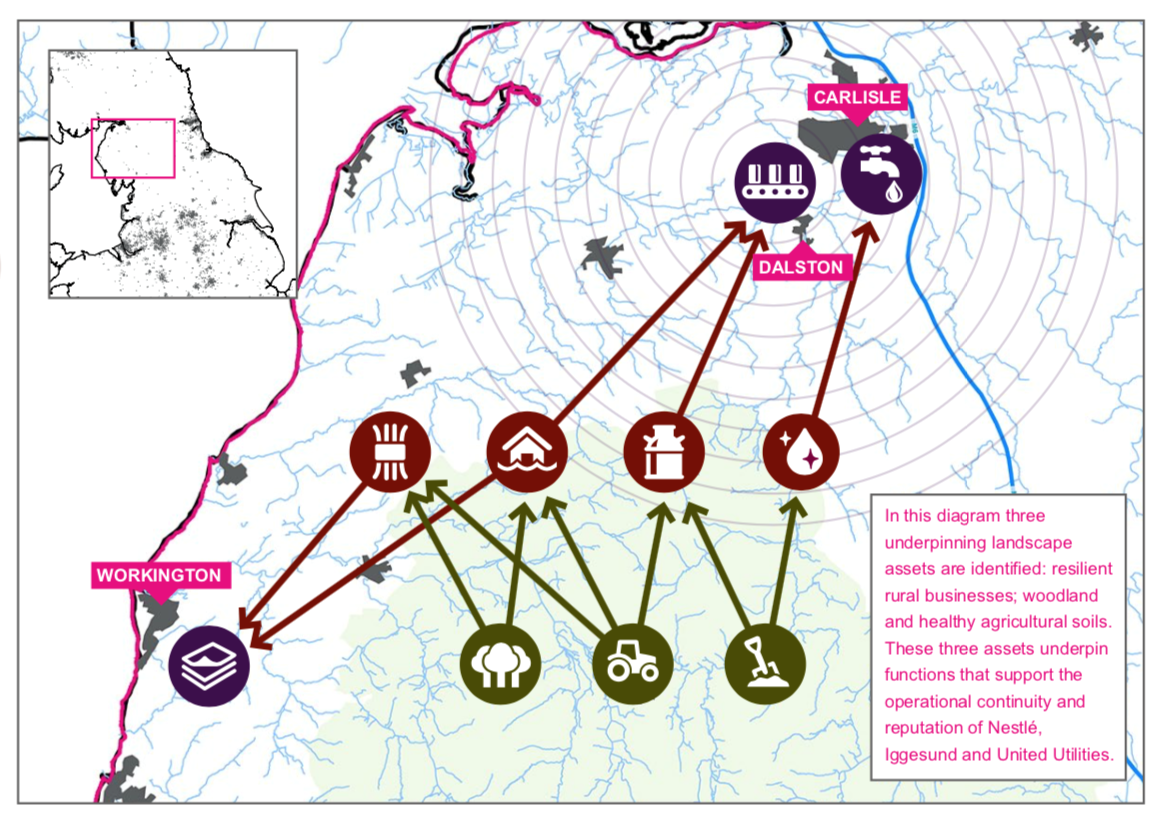

LENs builds coalitions of businesses around shared commercial interest in how landscapes function to drive investment and innovation around strategic assets like soils, aquifers, access infrastructure, habitats and tree cover.

For example:

- Supply chains serving Nestle’s Dalston plant (where they make their cappuccino range of products) are under threat from climate change (which will bring new animal diseases and limit water supply to dairy operations) and unsustainable agricultural practices (threatening the long-term health of soils and biodiversity)

- United Utilities share interests in improving the sustainability of agriculture in the area to enhance water quality and mitigate future water shortages

- Working with 3Keel, Business and the Community, the Game and Wildlife Conservation Trust, FirstMilk, the Rivers Trust, Woodland Trust and others, Nestle and United Utilities are pooling resources to deliver landscape scale public goods that benefit their businesses

- Dairy farmers supplying Nestle in the region have access a milk premium if they adopt measures designed to enhance public goods including animal health, welfare, water quality and biodiversity

Why do we need the LENs approach now?

Why do we need the LENs approach now?

Private place-based schemes:

- Are not subject to the same WTO constraints as publicly funded schemes

- Can be co-designed with land managers, including different and/or additional more attractive options

- Enable payments to be made more flexibly, at more competitive rates that are not tied to declining rates of public funding for agriculture post-Brexit

- May be more attractive to farmers, based on experience in Cumbria where LENs farmers have adopted LENs scheme options over agri-environment schemes, and gone out of milk at a lower rate than the rest of the sector without a single farmer moving to a competing co-operative

- Can be paid to land managers (as an alternative to landowners where appropriate)

- Can be paid whether or not they are active farmers, opening the opportunity for schemes to prioritise ecosystem services that cannot easily be delivered alongside the production of food or fibre

Do LENs deliver public goods?

The Resilient Dairy Landscapes project is assessing how the LENs in Cumbria is working and will provide evidence on how the LENs:

- Deliver ecosystem services, including climate change mitigation, water quality and flood mitigation

- Affect a range of common livestock disease dynamics

The LENs approach builds on decades of research into Payment for Ecosystem Services (PES), and more recent UK-based work to develop a place-based approach to PES (Reed et al., 2017). LENs follow this place-based approach, where multiple ecosystem services are delivered in the same landscape in a voluntary transaction between buyers and sellers of services, as part of a schemes that is developed and governed by partnerships of relevant stakeholders who hold shared values for the landscape.

The UK’s Peatland Code is the first regional carbon market to be developed following this approach, following from the success of the Woodland Carbon Code. Both Codes build on a rich evidence-base showing the multiple benefits for society of woodland planting and peatland restoration, enabling the schemes to provide guarantees to investors and safeguards to landowners and managers. Validated and verified projects from both schemes show that this approach is able to leverage private investment alongside public funding to deliver public goods that would not have been delivered through public investment alone.

How do LENs work?

Place-based PES schemes like the LENs approach typically look like this:

- Intermediary identifies public goods valued by businesses in a landscape, that without action may be under threat

- Evidence-based actions identified to protect/enhance those public goods

- Fundable projects developed (may be validated by independent body as likely to deliver expected benefits)

- Businesses individually or collectively fund projects, paying farmers or working with charities or others to deliver outcomes (may be governed by contracts for delivery of goods protected by pooled buffer of unclaimed goods shared across projects)

- Key natural assets and public goods are monitored (and can be verified by an independent body)

The Peatland Code and Woodland Carbon Code are restricted to two habitats and tend to focus on climate mitigation benefits. The Landscape Enterprise Network approach is now broadening this place-based approach to draw in a wider range of organisations to fund the delivery of a wider range of public goods from more varied landscapes and habitats.

Policy idea

Here is the big idea: Government could encourage and co-ordinate with private place-based schemes alongside publicly funded schemes.

The UK has led Europe in the development of private schemes for the delivery of ecosystem services, pioneering the development of the Woodland Carbon Code, the Peatland Code and the LENs approach. These approaches have particular value in a post-Brexit policy environment where there may be greater scrutiny of compliance with WTO rules.

Further information

The Resilient Dairy Landscape project is funded by the Global Food Security’s ‘Resilience of the UK Food System Programme’ with support from BBSRC, ESRC, NERC and Scottish Government. Find out more at: www.resilientdairylandscapes.com

The Landscape Enterprise Network approach was developed by 3Keel and Business in the Community with Nestle. Find out more at: https://www.3keel.com/landscape-innovation/

Reed MS, Allen K, Dougill AJ, Evans, K, Stead SM, Stringer LC, Twyman C, Dunn H, Smith C, Rowecroft P, Smith S, Atlee AC, Scott AS, Smyth MA, Kenter J, Whittingham MJ (2017) A Place-Based Approach to Payments for Ecosystem Services. Global Environmental Change 43: 92-106 https://www.sciencedirect.com/science/article/pii/S095937801630632X

The full policy brief can be accessed here.

For more information contact Mark Reed (mark.reed@newcastle.ac.uk) or Jenny Gilroy (jenny.gilroy@newcastle.ac.uk)

Last month I visited Taiwan, as a guest of the Taiwan Rural Sociological Society, to speak at an international conference in Taipei, to lecture at the National Taiwan University, and to visit rural communities and hear what they were doing. I also met the Minister of Agriculture,

Last month I visited Taiwan, as a guest of the Taiwan Rural Sociological Society, to speak at an international conference in Taipei, to lecture at the National Taiwan University, and to visit rural communities and hear what they were doing. I also met the Minister of Agriculture,